- Associate Member to European Union (Candidate to Full Membership)

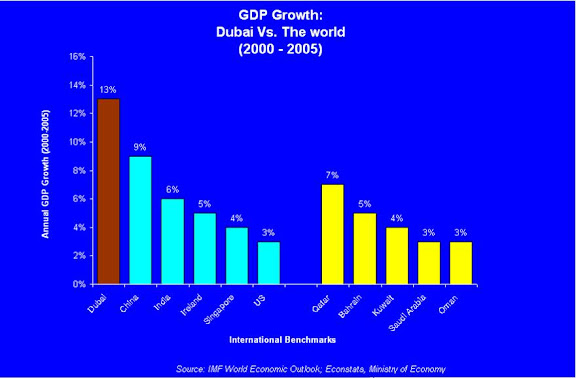

- Registered Economic Growth of more than 8% in 2004 - 2005.

- Capital: Ankara

- Population: 71 million

- Currency: New Turkish Lira

Economic Overview

‘So, just to confirm, you would like the mezes as a starter, the kebab as the main course and the baklava for dessert? Would you like any strong, almost oil like, coffee with that? :)

As you await the arrival of your food, you can’t help but survey your surroundings, expecting a Turkey you envisioned in books and movies…………just to find that it’s not all a 3rd World marketplace teeming with camels, men in white linen and oceans of sand.

Welcome to the real Turkey.........

Turkey is a developed country, with a political system established in 1923, under the leadership of Mustafa Kemal Atatürk, following the fall of the Ottoman Empire in the aftermath of World War I. Since then, Turkey has become increasingly integrated with the West while continuing to foster relations with the Eastern world.

The Islamist-based Justice and Development Party, which won a landslide victory in November 2002, has been a powerful force behind resolving many of Turkey’s long-standing economic problems.Prime Minister Recep Tayyip Erdogan early identified EU entry (as he should :) as his government’s key priority. He has pushed reforms to the court system and increased freedom of speech, long restricted my military influence.

But most importantly, the new government presided over dramatically better management of the economy.

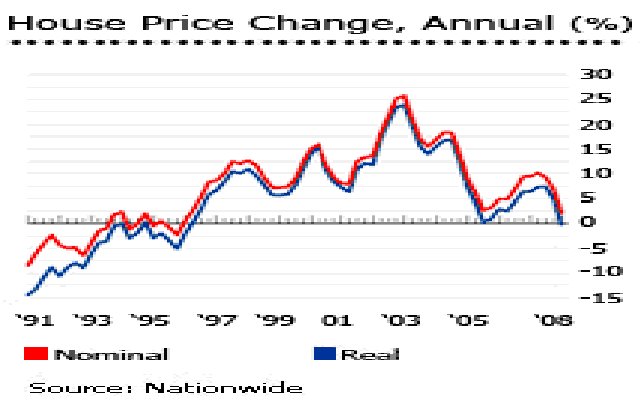

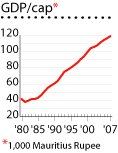

But let’s have a look at what the graphs have to say:

As you can see, there is a sharp increase after 2002 when the Justice and Development Party started their reforms to betterment of the Economy.

For decades, Turkey has suffered annual inflation of 25% to 106% per annum. Runaway inflation was successfully brought down from a decade’s old double-digit levels to a more acceptable 8.6% in 2004, and 8.2% in 2005.

Though inflation has unexpectedly picked up to 10.5% in Q3 2006, due to the rise in oil prices and various supply shocks, the authorities will have no truck with renewed inflation, and a tightening of interest rates by 4% in June, and a further 0.25% tightening in July, is expected to squeeze the higher inflation out of the system.

Have a look at the nosedive that inflation has taken since the 1980’s!!

Turkey has recently experienced a strong economic performance – a 5.8% growth in 2003, 8.9% in 2004 and 7.4% growth last year. Because of the tightening of interest rates, GDP growth to the third quarter of 2006 was a restrained 5.9%, and the full year figure is likely to come in lower. But although the graphs above tell a story of a country on the up, the biggest hurdle that Turkey has to cross is becoming part of EU……….and this has been met with strong opposition from France and Austria :( Therefore, analysts expect EU accession negotiations to be difficult and slow.

Property Market Review

So, if EU accession is the only thing that prevents Turkey from becoming a viable investment option, why are investors so eager to become part of this Juggernaut while things are still relatively affordable? Well, I’ll tell you……….

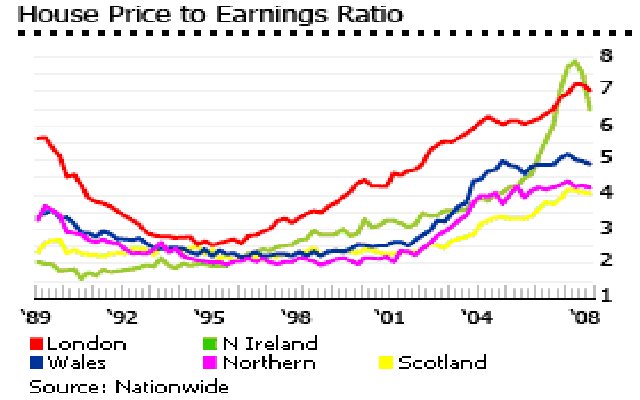

House prices continued their increases on 2006, following very sharp increases in 2005. Exactly how much house prices have increased is hard to tell, as Turkey publishes no official house price statistics, nor do any private organizations of realtors publish statistics !!

Therefore, Turkey is relatively ill-served by international realtors…….(can you where the potential lies? :)

So, the international market seems to be climbing in abated………but what about the domestic market?

Domestic housing loans have risen from 2% of GDP two years ago, to 14.4% of GDP by end-December 2006.The engine behind the increased borrowing was a significant decline in interest rates until mid-2006 (when an upward blip in inflation caused a rate tightening).

If you don’t believe me about interest rates, have a look yourself……

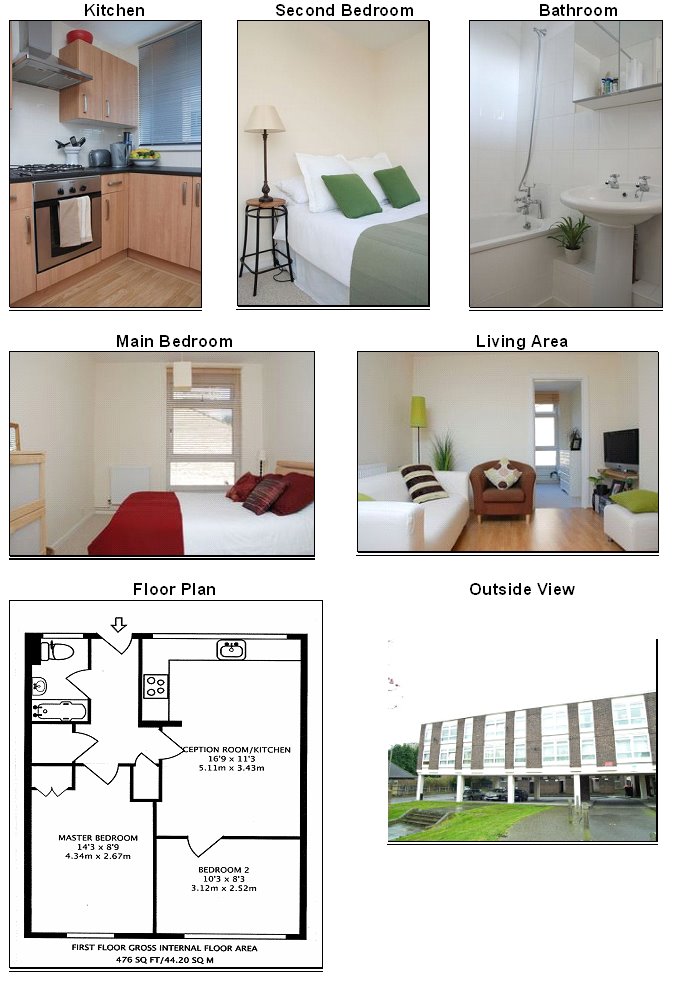

So, now that we have found that buying in Turkey is viable, let’s look at the particulars……..namely the Buyer’s Guide and what it involves:

1) Foreigner Restriction to buying Property?

Foreign ownership in Turkey is ruled by the reciprocity principle.

Citizens of countries that allow Turkish citizens or legal entities to own property in their country are allowed to acquire property in Turkey. Citizens of most EU countries (except for Belgium, Cyprus, Czech Republic and Slovakia), the United States, Canada and other countries in Asia, Latin America and Africa can freely purchase properties in Turkey.

On 07 January 2006, a new law was enacted which put a limit to the amount of land that a foreigner can purchase. Foreigners are allowed to acquire a maximum of 30 hectares (74 acres) of real estate. Any piece of land exceeding 30 hectares requires a permit from the Turkish authorities.

2) Rental Yields steady?

Gross yields in Turkey are moderate to high. Properties in central Istanbul offer yields of 6% to 7.6%, while property in coastal areas can yield 13% to 16% (but rents in coastal areas are predominantly seasonal).

Property yields in the suburbs are generally more attractive than in the cities. While apartments in Istanbul yielded around 6% to 7.5% at end-2005, Ankara apartments yielded from 7% to 9.5%.

Houses in the suburbs of Istanbul yielded around 6.5% to 8.5%, while house in the suburbs of Ankara, could yield 12%.

3) Is Turkish Law Pro-Landlord or Pro-Tenant?

Rents may be freely agreed at the beginning of rental contracts between Tenants and Landlords.

The lessor is required to inform the lessee at least one month before expiration of the lease of the amount of rent he wants for the new rental period. If the lessee does not agree to this amount, the lessor may request an assessment of the rental value of the property by applying to a court. The court will take into account the report of an expert as to the amount of rent appropriate for the property in question, taking into account prevailing market rents.

There is no other form of rent control in Turkey.

Apart from there being no rent control, the Turkish legal system generally favours tenants.

4) How much tax will I pay on my Property?

An example of what a Non-Resident would pay:

Non-resident couple's joint monthly rental income:

Tax Example: €6,000

Annual Rental Income 72,000

Less Exemption Amount (2,094)

Less Standard Costs (25%) (17,476.50)

= Tax Income 52,429.50

Income Tax Rates:

YTL6,600 – YTL15,000 ( 20%) 691

TL15,000 - YTL30,000 (25%) 1,099

YTL30,000 – YTL78,000 (30%) 2,356

YTL30,000 – YTL78,000 (35%) 3,678

Over YTL78,000 (40%) -

Annual Income Tax Due €15,648

Tax Due as % of Gross Income 21.7%

Conclusion

Now that Turkey is at the crossroads, between EU accession or not, the savvy investor should have a look at the calculated risk of investing in an economy where East meets West.

Are you such an investor?

Turkey has recently experienced a strong economic performance – a 5.8% growth in 2003, 8.9% in 2004 and 7.4% growth last year. Because of the tightening of interest rates, GDP growth to the third quarter of 2006 was a restrained 5.9%, and the full year figure is likely to come in lower. But although the graphs above tell a story of a country on the up, the biggest hurdle that Turkey has to cross is becoming part of EU……….and this has been met with strong opposition from France and Austria :( Therefore, analysts expect EU accession negotiations to be difficult and slow.

Turkey has recently experienced a strong economic performance – a 5.8% growth in 2003, 8.9% in 2004 and 7.4% growth last year. Because of the tightening of interest rates, GDP growth to the third quarter of 2006 was a restrained 5.9%, and the full year figure is likely to come in lower. But although the graphs above tell a story of a country on the up, the biggest hurdle that Turkey has to cross is becoming part of EU……….and this has been met with strong opposition from France and Austria :( Therefore, analysts expect EU accession negotiations to be difficult and slow.