Dubai – The Land of Oil and Sand

Fast Facts

· No Income, Capital Gains or any Property Related Tax.

· Residence Visa is granted to any property purchase.

· Capital: Dubai

· Population: 2.2 million

· Currency: UAE Dirham

· Residence Visa is granted to any property purchase.

· Capital: Dubai

· Population: 2.2 million

· Currency: UAE Dirham

Economic Overview

Six thousand years ago, the city of Babylon was the wealthiest in the World. It was a city of incalculable wealth, both loved and loathed across the globe for its opulence and excess.

It was built in the desert on sand and rock & stood for thousands of years, even though many prophesised that Babylon would fall ahead of its time……….Does this sound familiar?

Dubai refers to one of the seven emirates in the United Arab Emirates (UAE).

The modern emirate of Dubai has been ruled by the Al Maktoum dynasty since 1833. The emirates' current ruler, Mohammed bin Rashid Al Maktoum, is also the Prime Minister and Vice President of the UAE.

The Economy of Dubai is valued at US$ 46 billion and has been described as "centrally-planned free-market capitalism." Although Dubai's economy was built on the back of the oil industry, revenue from petroleum and natural gas currently account for less than 3% of the emirate's gross domestic product. (You didn’t know that, did you? :)

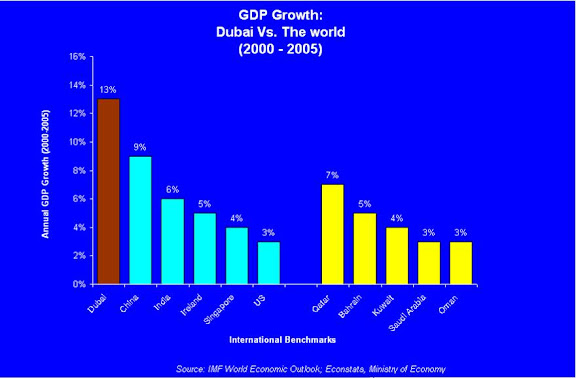

So, for you ‘right-side brain thinkers’, let’s back up all these figures we’re throwing around and look at some graphs:

Now don’t get me wrong,13% GDP growth per year cannot be sustained……….and even if and when this growth recedes, would you still be happy with 5-10%? :)

Dubai is also an important tourist destination and port (Jebel Ali, constructed in the 1970s, has the largest man-made harbour in the world !!). It is also starting to develop as a hub for service industries such as IT and Finance, together with the new Dubai International Financial Centre (DIFC).

(It is rumoured that Dubai’s oil reserves will dry up by approximately 2020, and that is why they need to steer away from oil related industries. Thus far, they’re doing a fatastic job – And did I mention that Dubai was voted safest city in the World by Interpol for the past 4 years?!!)

Property Market Review

Now before I get lambasted on how Dubai is 1) built on sand, 2) the oil is drying up, 3) many property developments are behind on schedule and might never be completed, etc etc……let me just say that for every negative calamity prophesised (remember Babylon?), every one of them has been proved incorrect thus far.

People need to live and work in Dubai. And as a place to do business, as a trading centre, Dubai continues to exceed every expectation.

In March 2008, Standard Chartered Bank forecasted an average growth of 15% in Dubai real estate prices, with net new demand for 70,000 residential units and a supply of only 57,000……….boggles the mind, doesn’t it? :)

Dubai is gaining traction as a place to live and work, despite the stress, heat, noise, and high prices. Staff numbers are surging at the Dubai International Financial Centre, an international financial hub regulated to global standards with its law in English.

Rents continue to rise in line with prices, according to Global Property Guide research. Rental yields range from 10.20% on the smallest units, to 6.88% on the largest units.

Apartments

Size = 50 sq. m.

Cost = $206,400

Yield = 10.20%

Cost = $206,400

Yield = 10.20%

Size = 100 sq. m.

Cost = $409,500

Yield = 8.23%

Size = 150 sq. m.

Cost = $605,400

Yield = 7.21%

Cost = $605,400

Yield = 7.21%

Size = 200 sq. m.

Cost = $794,800

Yield = 7.00%

Size = 250 sq. m.

Cost = $897,000

Yield = 6.88%

(These apartments are the average of the following Development:

Burj Dubai, Dubai Marina, Jumeirah Beach Residence, Jumeirah Lake Towers & Palm Jumeirah)

Now before I get thumped by the ‘But Brigade’………But what about this?..... But what about that?…..but, but, but…..

Just look at the figures below !!.......and don’t come and tell me that transaction costs are high:

TRANSACTION COSTS

Who Pays? (Buyer)

Who Pays? (Buyer)

Title Deed = 250AED

Registration Fee = 1%

Who Pays? (Seller)

Registration Fee = 1%

Real Estate Agent's fee = 1.00% - 5.00%

Average Costs paid by buyer

Average Costs paid by buyer

1.01% - 1.05%

Average Costs paid by seller

2.00% - 6.00%

So what are the benefits of buying in Dubai? And how do we go about it?

Foreign nationals (that’s us) are allowed to buy freehold properties in designated areas in Dubai. Gulf Cooperation Council (GCC) whilst nationals (that’s Dubai residents) are allowed freehold ownership anywhere in the Emirates.

Residence Visas are issued to property owners, which extend to their immediate families. These visas are renewable every three years during ownership. (So much for having to live in London for 5 years before you get a passport :)

Property Development can be either be bought using financing from the different commercial banks in Dubai (Foreigners can qualify for 90% mortgages) or staggered payments to the developer before completion. Once the development is completed and units can be handed over to the buyers, full payment of the purchase price must be made.

Combine this favourable buying process with No Income tax, Capital Gains or any Property Related Tax, and you have an almost perfect investment environment.

Conclusion

This modern day Babylon seems to defy logic with its incredible vision of wealth and splendour. But the questions remain:

‘When will it all end?’ ‘And will Dubai crumble and return to the sands on which it was built?

‘Or, will this city prosper and emulate the Babylon of old?

I for one back the latter.

(To view our current Dubai Developments, please click HERE