Monday, 28 March 2011

Residential demand strengthens further in the 1st Quarter of 2011

From a property owner/investor's point of view, one would typically want to see a strong market, which implies that demand is strong relative to supply of residential stock.

This relative shortage of residential stock would then lead to solid capital growth of the asset, a strong contributing factor to total financial return on one's property. Unfortunately, the past few years have not seen any meaningful capital growth, due to generally weak demand relative to supply.

In the past two quarters, the FNB Estate Agent Survey once again began to show estate agents perceiving strengthening housing demand, which may be largely seasonal as is customary in the summer season, but which may also be partly due to two further interest rate cuts by the Reserve Bank (SARB) late in 2010.

So, from an agent residential demand activity rating of 5.66 (scale of 1 to 10) in the 3rd quarter of 2010, the level has increased to 6.07 in the 1st quarter of 2011. The agents surveyed in the 1st quarter also reported a very significant increase in the number of viewers at their show houses that they perceived to be "serious buyers".

However, it has become interesting, with the agents surveyed simultaneously report a significant lengthening in the average time of homes on the market prior to sale, from a previous 15 weeks and 6 days to the 1st quarter's 19 weeks and 1 day, as well as an increased percentage of sellers having to ultimately drop their asking price to make the sale, from a previous 80% to 85% in the 1st quarter.

This may suggest that stronger demand has not yet led to an improved market balance, possibly because it is being matched by stronger supply of residential stock on the market. The evidence that we have of stronger supply is perhaps not yet solid, but there are signs. For one, our FNB Valuers as a group have on average been giving stronger supply ratings in their valuation reports in recent months.

As for the estate agents, after an increase in the percentage of survey respondents reporting "stock issues" (constraints) from late-2009 and through the winter of 2010, that percentage declined noticeably in the summer 2010/11 quarters, i.e. the 4th quarter of 2010 and the 1st quarter of 2011.

In addition, when examining the various reasons for selling, we sense that there is evidence of improved supply of stock coming to the market too. The evidence lies in the fact that agents have reported an increase in the percentage of what we call "selling for non-negative reasons". These reasons are "selling in order to downscale due to life stage (e.g. retirement or kids leaving home), selling in order to upgrade, selling in order to re-locate to elsewhere in SA (mostly for better job opportunities), and selling in order to move closer to work or amenities.

We believe that a greater portion of such categories of sellers are not in a rush to sell, compared to those selling in order to downscale due to financial pressure for instance, and thus are possibly more willing to bide their time, coming out of the woodwork in larger numbers when they perceive it to be a relatively good time to sell. Recently, a significant increase in sellers selling for "non-negative" reasons suggests to us that there has perhaps been an improvement in the confidence that sellers have in their ability to get their price, bringing an increased number of aspirant sellers out of their hiding places.

This apparent development on the supply side is all part of the long residential market healing process. One should expect that, after an improvement in demand there should at some stage be an improvement in seller confidence as well.

However, this event would also serve to slow the pace of return to a better market balance, with a better market balance ultimately being reflected in a significantly shorter average time of properties on the market along with a smaller percentage of sellers having to drop their asking price.

It would also be likely to delay the return of respectable growth to house prices. Such is the long slow nature of the residential property market recoveries - patience required.

Friday, 15 October 2010

Commercial property under pressure

He warns that there has been a dramatic drop in the number of developments underway and even existing projects are being reassessed to avoid adding to the widespread over-supply of office accommodation.

“Office vacancy rates have increased since last year and this picture is unlikely to change before 2011 or perhaps 2012,” he warns. “Increased spending in the retail sector might have an impact on reducing vacancy rates in retail shopping centres in the short term,” he claims.

Hyprop Investment’s Mike Rodel says that the time is ripe to get particularly good rental deals from agents or developers who are keen to boost occupancy levels. Rodel says that Hyprop is expecting national retail sales growth of between 7% and 10% over the next two years with regional centres growing by up to 12%.

Rodel says that the margin of operating costs to gross rentals has continued to rise and increased from 30% two years ago to 40% now and high vacancy rates have made it difficult for owners to pass the rising costs on to the tenants.

Viruly warns that the biggest difficulty facing developers is to keep the operating costs in retail centres under control as the operating margins are too high at the moment and need to be brought back under control.

“There are likely to be some retail opportunities that do arise in the short term – such as for retail space on Gautrain stations – but the retail property market will remain under pressure until at least the second half of next year,” says Viruly.

Broll says that while there has been pressure on the retail and office market, there are still some impressive deals being done. The company recently sold two investment properties in Cape Town.

The first, 43 Bloulelie Crescent in Plattekloof sold for R13,5-million and 5 Ravenscraig Road in Woodstock sold for R33,75-million.

The Bloulelie Crescent property is let out to medical professionals while the Ravenscraig Road building is home to a large printing firm in a traditional industrial area.

According to Sean Berowsky, national property investment specialist at Broll, the interest levels from investment buyers has remained high, particularly for prime commercial and industrial properties.

He concedes that transactions have been restricted by the limited negotiability of sellers because of prevailing low interest rates and the limited stock that’s available.

“The difficult funding environment facing buyers means that there must be a substantial injection of equity,” he says. “Well-tenanted properties with good income streams are still easy to sell whereas buildings with high vacancy rates are not attracting much interest at all,” he adds.

Friday, 1 October 2010

Airports let property markets take off

So says Gerhard Kotzé, CEO of the ERA South Africa property group, who adds that airports and their expansion still generate mixed reactions, but there’s little doubt that the economies of surrounding areas benefit.

“South Africa, under the impetus of the Soccer World Cup and other influences, has extensively upgraded its airport infrastructure recently in terms of both international and regional feeder services.

“Unsurprisingly, the biggest investment of late has come from the Airports Company of South Africa (ACSA), which has now come to the end of a R17bn development programme, including the commissioning of spectacular new terminal buildings at OR Tambo International, Cape Town International and KZN’s King Shaka International airports among others.”

This kind of parastatal development is to be expected, he says, particularly in support of a major sporting event such as the World Cup but it’s interesting to note the private sector development of airports in recent years as well, including the major upgrades of Lanseria and Wonderboom airports.

“And new property development flows in the wake of these projects - in the case of Lanseria International for example, now Gauteng’s second biggest airport, a new R200m industrial estate with further investment of some R7bn over time is in the pipeline which in turn is expected to spark off additional residential development.

“Surrounding Wonderboom, a residential air park is being constructed along the lines of much talked-about developments of this nature in the US elsewhere in the world, while in the Welkom area a R3bn, three-phase development project including residential, entertainment, cultural and sports facilities is reportedly on the cards.”

Similarly, the development of King Shaka International north of Durban has definitely stimulated property markets in La Mercy, Umhlanga, Ballito and other north coast centres while in Mpumalanga, the Kruger Park

Mpumalanga International airport is credited with spurring all manner of economic activity in Nelspruit and beyond, Kotzé notes.

“Clearly there will always be those who avoid acquiring property in airport approach areas, but on balance it would seem the benefits of airport development for the property sector are very positive.”

Elwyn Schenk, Pam Golding Properties (PGP) area principal in Umhlanga, Umdloti and La Mercy areas, says the Umhlanga node north of Durban is firmly entrenched as the area of choice for residents, investors and commercial end users alike.

“Thus prices in the area have remained fairly stable during the difficult economic conditions. Part of the reason for this, we believe, is that the potential for the area has been enhanced by the King Shaka International Airport and the Dube Tradeport.”

Durban's north coast has all the ingredients to develop into a similar, but still different, version of Cape Town's Atlantic Seaboard.

“The mild and sunny climate year round, beautiful beaches – add to this the rapid growth of the Umhlanga node and proximity to Gauteng (one hour's flight) and you have all the ingredients for rapid future growth. While certain areas such as Umhlanga and Umdloti are heavily developed, there is significant coastal land still available for expansion, in particular La Mercy, 5km from King Shaka Airport, offers substantial potential.”

“Global trends have shown that areas in close proximity to an international airport benefit from sustained and rapid growth. Commercially the Dube Tradeport will serve as a catalyst for economic development which will see KZN emerge as a major SA business node, serving Sub-Saharan Africa and the Far East in particular.

Experience has shown that property prices, both residential and commercial, will benefit from these developments. Commercial demand will come for hotels, engineering and other industries which service the airport, such as food services and import/export companies.”

Schenk says apart from the normal infrastructural development around airports – fuel depots, catering services, maintenance etc. – history the world over has shown that a new airport in particular will bring substantial additional development in peripheral industries such as freight companies, import/export agencies and related activities. “Passenger services and hotels are also attracted to a new airport facility.”

“Thus airports bring in their wake a substantial permanent population, together with a transient population ranging from contract workers to every day tourists.”

The effects of these demographic changes on the property industry are profound, especially in the medium to long term. “The trend for big businesses to move from the CBD into the north has been evident for some years and Umhlanga has been a prime beneficiary of this.”

He says future expected trends arising from the airport area will be a demand for mid-price housing from the blue collar workers, a surge in rental demand for the same reason and an increase in investor demand.

Clive Greene, PGP principal in Ballito, says the King Shaka Airport has created positive sentiment in the market. "Rental enquiries have increased twofold."

He says enquiries on properties for under R1m in the vicinity of the airport have picked up. “Sales on these lower cost properties are selling well. Caledon estates are nearly sold out with over 100 units sold.

In Sheffield Manor Estates there have been over 50 sales in the last five months and Sheffield Manor over 100 sales in the last 10 months. Simbithi Estate continues to sell very well, offering a secure lifestyle for old and young families.

He says commercial development will definitely increase as land has been allocated around the airport for development and Ballito is starting to offer large tracts of land for commercial use. “This, in turn, will increase demand for more residential property. The future for this area in the medium to long term is exceptional.” – Eugene Brink

Strand Beach Road sales pick up

Benhard Wiese, principal associate of Cape Coastal Homes, says these better-than-national sectional title sales figures are attributable to the area offering much better value per square metre than the similar property offerings on e।g. the Cape Atlantic seaboard.

“The buyers interested in Strand Beach Road are also buying with a long term view – mostly viewing the property as their second home to be converted into their retirement home.”

He says only 7% of the registered sales of apartments older than three years on Beach Road have during 2010 been for less than present comparative property values per sqm – a sign of a solid market that escaped the storms of 2008/9 relatively unscathed.

“The availability and affordability of credit coupled with the surplus of available new development apartments on Beach Road since 2007 had suppressed capital growth during 2008 to 2010. According to CMA Info, there had been 46 sales in Strand Beach Road during 2008 - that is about four sales per month.”

The volume of sales, however (excluding inheritance), during 2009 grew to 86 transactions of which 25 were new developments and 61 were older complexes.

Excluding all new developments registered in the Deeds Office, there was still a growth in sales volume of about 37% from 2008 to 2009 on Strand Beach Road - totally contrary to statistics from SAPTG which indicate that nationally sectional title (apartment) property priced between R300k to R5m reported an overall decline of 39% in transfers between 2008 and 2009.

The average price per sqm for the 61 registered sales in 2009 for all apartments older than four years on Strand Beach Road (i.e. excluding the new developments which occurred at a higher average price per sq/m) was about R12,900/sqm whilst the new developments registered average prices in 2009 was R17,725/sqm.

The first semester of 2010 has seen a continuation of the growing sales trend on Strand Beach Road with 41 sales being registered according to SAPTG in the Deeds Office of which 14 were new developments built since 2008 (e.g. Hibernian Towers and Topaz).

The average price per sqm for the registered sales in the first semester of 2010 for all apartments older than four years on Strand Beach Road (i.e. excluding the new developments) was about R13,462/sqm.

The new developments average registered prices in 2010 have been ranging between R12,686/sqm for Ocean View to R23,225/sqm for Topaz.He says total registered sales for the first semester of 2010 for the 4 new developments on Strand Beach Road had been R30,524,151 at an average of R15,439 for the 1977sqm sold. That is about 13% lower than the average registered sales prices achieved for new developments during 2009 of R17,725 per sqm.

Interestingly enough, there has only been about a 13% difference in average prices obtained (registered) between older apartments and new developments (less than four years old) during 2010. The present price structure of Beach Road properties can be roughly categorised in different groups according to "age, finishes and size".

The smaller the apartment, the higher the price achieved per sqm. The quality of sea view also has a big effect on the property’s value.Prices obtained in 2008 varied between R7,600/sqm (Strandsig) to R24,700/sqm (Cape Sands). The apartment prices in 2009 varied between R8,500 per sqm (Welgelegen and Jacomahof) to R23,900 per sqm (Hibernian Towers). Beach front apartments were selling in 2003 from about R6k/sqm to about R9k per sqm.

Beach Road property in general has not been subjected to the same forces which have been experienced in e.g. the buy-to let investor property sectors where capital growth has seen fairly substantial drops. The growing foreclosure or bank repossessions trend created during 2008/9 and during the first semester of 2010 effected a strong downward pressure on prices obtained in the buy-to-let property market.

Some auctions at the entry level investor sectional title market (priced at up to R450k) have towards the end of 2009 seen prices drop by as much as 50% of what was the perceived value of the property in 2007. Auctions on Beach Road have, however, been a very small part of the transactional horizon and were therefore not a distinct negative capital growth factor at all.

Only a few distressed sales in some of the new developments took place – without any real effect on the rest of the older blocks, where most of the owners opted to keep their apartments from the market – especially if they did not need to sell.

From the 27 sales which had been registered in the Deeds Office during the first months of 2010, only two transactions took place at prices which seem to be much lower than other comparative properties per sqm – a Romilly apartment at R8,426/sqm and an apartment in Strandsig at R7,432/sqm.Only 7% of all transactions on Beach Road during 2010 amongst the older-than-4-year-old apartment blocks had been registered for much lower than comparative market value.

The last two years has been a sobering period for all property owners in the country – including Beach Road Strand. The unrealistic capital growth expectations have been tempered to pre-2003 growth levels.

Although apartment prices got far “out of touch” with incomes levels during the boom, it is to be expected that inflation will in the next few years close this gap considerably.

“Strand Beach Road has during the last few decades always operated on an eight to ten year tide pattern – with surges of new developments coming every eight to ten years. Buyers who are waiting for Beach Road prices to drop are doing it at their own peril,” he concluded.

Friday, 17 September 2010

How Affordable is Cape Town Property?

Accessible pricing remains a major obstacle to many new entrants to the housing market, and is a crucial factor for many other buyer types, including those downscaling for retirement or wishing to upgrade to meet the needs of a growing family.

Yet affordable homes are not a myth, says Pam Golding Properties’ MD for the Western Cape metro region, Laurie Wener.

“There are a number of suburbs in the Cape Town metropolitan area where one can obtain decent, well-built homes in the R600k to R3m price range, ranging from compact apartments ideal for young couples and professionals, to larger free-standing homes. If one only knows where to look, one may be surprised by the value for money which can be obtained, and the large variety of stock which is currently on offer.”

Western Seaboard Cape Town’s Western Seaboard has long been a popular area for first-time buyers, young professionals and downscalers seeking compact, affordable homes which are easy to maintain.

In recent years as the residential area has expanded in size, so too has the offering of schools, shops, hospitals and other amenities, making these suburbs increasingly popular with young families as well.

PGP’s area manager, Ivan Swart, says there is a wide variety of affordable housing options to choose from in suburbs like Parklands, Sunningdale, Flamingo Vlei and Bloubergrant, as well as in the Melkbosstrand area further to the north.

These range from studio apartments to secure complexes and even free-standing homes. “Newer areas such as Big Bay and Atlantic Beach Golf Estate are growing rapidly in popularity with this segment of the market, and we continue to see a lot of offers from first-time buyers, older buyers downscaling for retirement, and young professional couples.

Unfortunately the limited access to mortgage finance remains an inhibiting factor, but the demand is certainly there.”

For R600k to R1m, one can obtain a two-bedroomed apartment, ideal for new entrants to the housing market and young couples. In the R1m to R2m price range, one can buy a sizable free-standing family home with three bedrooms and a double garage in Parklands, Sunningdale, Flamingo Vlei, Bloubergrant, or Melkbosstrand. This price bracket will also secure a starter home in the secure Atlantic Beach Golf Estate.

“For buyers in the R2m to R3m bracket there is even more choice, from a free-standing starter home in the Atlantic Beach or Sunset Links Golf Estates, Big Bay estates or Sunset Beach, to a two-bedroomed beachfront apartment, suited to those who are retiring or for those wanting a lock-up-and-go lifestyle.

We have a wide selection of stock in the latter category at present, with some excellent value for money on offer.”

South Peninsula

The towns of the South Peninsula also offer a number of options for buyers seeking property below R3m – and they often come with a view or even walking-distance access to the beachfront।

One can obtain a free-standing three-bedroomed home in Kommetjie for under R2m, or a cottage in Scarborough for R1,25m.

PGP’s area manager Sandi Gildenhuys says there are also a number of homes in this price range in Fish Hoek. “One can obtain a one- or two-bedroomed apartment in central Fish Hoek for just R500k to R600, while most free-standing homes in the valley sell from around R850k to R1,4m.”

Mountainside properties commanding panoramic views are a little pricier, but still a very affordable R1,8m to R3m. The town has always been popular with retirees due to its lovely flat and easy-to-access beachfront, but is also attracting young families and even professionals who commute into town.

Towns like Kommetjie and Noordhoek are also attracting increasing numbers of young families who are choosing to raise their children in a more rural environment, and who want affordable, sizable family homes.

Southern Suburbs

Cape Town’s leafy Southern Suburbs are widely perceived as offering quality family homes on large plots, located close to the University of Cape Town and a number of top schools. The reputation is fully justified, and such homes frequently come with substantial price tags.

But, says PGP’s area manager Howard Markham, it would be inaccurate to think that the Southern Suburbs are out of range of smaller budget buyers. “There are a number of options for entry-level buyers and young couples wanting to obtain a foothold in this sought-after market, and even for family buyers needing larger homes.

“Suburbs such as Observatory, Claremont, Kenilworth and Pinelands offer plenty of homes priced under R3m, as do Bergvliet and certain pockets of Tokai. One can still obtain a three-or four-bedroomed home on up to 800sqm, within this range.

And Harfield Village, for example, is growing steadily in popularity with first-time buyers and young couples without children, who love its manageable-sized plots, attractive homes and central location. One can buy a four-bedroomed home with a double garage here for R2,35m.”

Markham says there is also limited activity in the investor market under R3m at present, mainly from parents buying sectional title units for their student children.

Atlantic Seaboard and City Bowl

The growth of residential opportunities in Cape Town’s Central City has opened up many new options for entry-level buyers and those seeking homes under R3m.

One can obtain starter apartments in the heart of the business district for around R500k for a bachelor unit, or R1m to R2,5m for larger two-bedroomed options. These are extremely popular with young professionals working in the city, and are also considered by investors due to the rental returns they can command.

Those wanting to live close to the sea might consider Mouille Point, where one can still obtain a one-bedroomed apartment from R1,25m. And in neighbouring Green Point, bachelor flats are priced from around R500k, while larger two-bedroomed units can be obtained for closer to R2m.

Although more upmarket areas of the City Bowl, such as Oranjezicht and Vredehoek, tend to attract higher prices, it is still possible to obtain older homes in these areas for under R2,5m, says PGP’s area manager Basil Moraitis – if one has the budget and willingness to carry out renovation work.

Lanice Steward, MD of the Cape Peninsula estate agency Anne Porter Knight Frank (APKF), says the emerging middle class will boost prices in the traditional Cape suburbs.

“Anyone buying for investment purposes in the Cape Peninsula right now will be onto a sound investment no matter which suburb he chooses,” said Steward.

“The reason is clear: with a mountain and a nature reserve taking up 65% of the available land, property in the traditional Cape suburbs will increasingly be in short supply. It is in these traditional suburbs that the emerging middle class aspire to live.

“This does not mean that Cape Flats suburbs like Grassy Park, Mitchells Plain and Ottery will not gain in value, but areas like Lower Wynberg, Rondebosch East, Diep River, Retreat, Goodwood and Sea Point, which are still low priced are set to take off.”

The best long term prospect, and the one she would tip to any person looking for a lifestyle as well as a sound investment, said Steward, is Simons Town.

“With commuting problems hitting the outlying areas, the convenience of a comfortable 53 minute train ride to the city is increasingly appreciated. Add to that a charming Southampton-type main street, good restaurants, a flourishing yacht club, a challenging golf course (currently in near-perfect condition), a lively cultural life and wonderful mountain walks and minimal crime, and it is quite clear that a decade from now Simons Town will be the place to live.”

This fact, said Steward, is already recognised by buyers who can expect to pay anything from R2,5m to R4m for a standard three bedroom house, but who are still able to find bachelor pads below R1m while at the upper end of the price range there are many homes priced in the R10m to R20m bracket. – Eugene Brink

Saturday, 29 November 2008

‘For the times, they are a-changin’.........maybe

Even when you read these words above, the whiny voice of Bob Dylan pops into your head willing you to sing along even if you don’t want to. Compare this to the current property situation, the questions remain:

Are the times for property really changing?

Or are things going to get a lot worse before they get better?

For the past 2 years, interest rates have been increased 10 times in order to curb the inflation monster. Current prime rate stands at 15.50% whilst inflation has peaked at 13.6% (a far cry from the projected 3%-6% margin set by the SARB) The Rand has devalued by 40% this year alone & our political situation leading into the 2009 elections, seems wonky at best.

But to every cloud there is a silver lining? Maybe.......

In the past few months, USA, Australia, New Zealand, the European Central Bank, Turkey and even England have cut their interest rates in order to prevent the looming global recession. So why is South Africa the odd one out?

Trevor Manual has said that the impact of the global recession still has to be absorbed into the economy, and therefore a ‘wait and see’ attitude is currently held. But with real estate agents down 50% (maybe not such a bad thing), stock market down, platinum down & business confidence down, maybe it’s time to light the fires & burn the tires !!

(As long as the Rand doesn’t weaken more to negate the expected rate decrease)

The MPC meets on 11/12 December.

Let’s hope they take a feather out of the cap of the Springboks victory against England, by defying the odds & putting the market on course for a recovery leading into 2009.

Please Uncle Tito, how about an early rate cut to get us into the Christmas spirit........

Sunday, 3 August 2008

United Kingdom - The Land of Fish and Chips

Fast Facts

· 2nd Biggest Economy in Europe

· No restrictions on foreign ownership when buying property.

· Capital: London

· Population: 60 million

· Currency: British Pound (£)

‘Oi !!.......you there, Wha’ fish you wan wiff them chips, then? I aint sellin’ no chips with no fish, innit’…..

And thus our adventure with the United Kingdom and all its peculiarities get off to a good start. But apart from the adventure, experience and ‘Greener Pastures Syndrome’, what makes this mud island one of the best places, to start your property empire?

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK), is a sovereign island country located off the north western coast of continental Europe. The UK is a union of four constituent countries & is governed by a parliamentary system with its seat of government in London, & is a constitutional monarchy with Queen Elizabeth II as the head of state.

The UK is the fifth largest economy in the world & is one of the world's most globalised countries with London being the major financial centre of the world, in front of New York City, Hong Kong and Singapore.

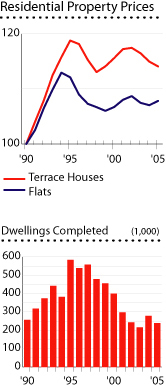

In 2008, a flat in central London sold for £115m, which is believed to be the most expensive apartment the world. (Crazy money if you ask me!) That aside, UK house prices are slowing down & the long-lasting property boom seems over. UK house prices fell by 2.5% in March 2008 which is also the biggest monthly decline since September 1992. To show you what this means in the big scheme of things, have a look at the graph:

100% mortgage loans are now no longer offered & borrowers looking for new mortgages are being thrown into complete chaos, as deals they have agreed with their broker, disappear from the market just hours before applications were to be signed. (This also happened to me !!)

So, with all these doom and gloom predictions, will we if ever, return to a hint of normalcy?

Property Market Review

The UK property market is currently in decline thanks largely to the phenomenon called the ‘Credit Crunch’? (Ever heard of it?)

Definition: A credit crunch is a sudden reduction in the general availability of loans, or a sudden increase in the cost of obtaining loans from commercial banks. So, why the ‘sudden reduction in giving out loans? Show us why in Graphs they cry !!

Have a look at the affordability of property prices by the above graph which is the ratio between house prices and earnings. House prices are now 7.0 times earnings in London, 5.7 times in the South West, 4.6 times in the Midlands, 4.5 times in Yorkshire and Humber, and 4.0 times in Scotland.

This means that UK house prices are currently more overvalued now than they have ever been !! (And if I was a bank, I’d also reduce funding until affordability returns to some vestige of normality)

So, what about the ‘upside’? …….(The UPSIDE??!! Are you kidding me??!!)

Apart from the doom-and-gloom scenario as discussed, there are still ‘pockets of light’. Rental incomes have increased at an average of 16.7% over the past year & London yields are showing a very healthy 5.7% .

A major contributor to this yield is immigration which is not only featured in London as many may think. Across the country, the average proportion of properties taken by immigrants is 20% as the UK continues to attract immigrants due to job opportunities (No, this isn’t only us Saffers !!) In addition, the economy remains strong with retail sales in the year to February rose by a stronger-than-expected 5.5 %.

Furthermore, UK house prices have been continually on the rise since 1995. From late 1995 to 2008, average UK house prices have risen from £50,930 to £179,363.This is an overwhelming 252% increase !!

Also, UK house-building has largely failed to respond to booming house prices for the past decade, largely because of building regulations. Increases in population, immigration, and a decrease in unemployment, have all added to the demand for housing as have changes in household sizes.

The Barker Review (HM Treasury), concluded that to reduce the trend in real price inflation to 1.8%, the rate of new home building would have to increase by around 70,000 homes per annum to around 195,000 per annum. Government figures show that homebuilding stagnated at 148,000 new units annually between 1989 and 2005.

In 2006, 180,000 new homes were built which is still low compared to 425,000 units in 1968……..

Conclusion

So forget the credit crunch, affordability & high interest rates, because as long as the UK can maintain its demand for a skilled worforce, the economy will march on unhindered through the storm.

Saturday, 19 April 2008

Property Review - Egypt

Egypt - The Land of the Pharoahs

Fast Facts

· GDP growth currently at 7%

· No capital gains or inheritance tax.

· Capital: Cairo

· Population: 80 million

· Currency: Egyptian Pound

Economic Overview

'I don't where to go first, the Pyramids of Giza or the Valley of the Kings? Why not do both and even add on a Red Sea scuba dive in Sharm El Sheikh'? Well, that depends on how much time you have? Oh.........about a week'

You might need a little longer than that, as you'd only be able to cover half of Cairo in a week J'

Officially, the Arab Republic of Egypt, is a country in North Africa that includes the Sinai Peninsula, a land bridge to Asia. It borders Libya to the west, Sudan to the south and the Gaza Strip and Israel to the east. The northern coast borders the Mediterranean Sea; the eastern coast borders the Red Sea.

Egypt declared its independence from Great Britain in 1922 and only became a Republic in 1953. Hosni Mubarak became Egypt's 4th President in 1981 since being declared a Republic and is currently serving his 5th term in office.

Under comprehensive economic reforms initiated in 1991, Egypt has relaxed many price controls, reduced subsidies, reduced inflation, cut taxes, and partially liberalized trade and investment. This has promoted a steady increase of GDP, as well as the annual growth rate. The Government of Egypt tamed inflation bringing it down from double-digit to a single digit..........Wanna see?! :)

Egypt is currently, truly coming into its own and the emerging sectors such as IT Sector and the Investment Climate (yay !! :) are showing the way !!

The Egyptian IT sector has been growing significantly since it was separated from the transportation sector. The market for telecommunications market was officially deregulated since the beginning of 2006 according to the World Trade Organisation agreement.

The government established the Information Technology Industry Development Agency (ITIDA) as governmental entity. This agency aims at paving the way for the diffusion of the e-business services in Egypt, capitalizing on different mandates of the authority as activating the Egyptian e-signature law, and supporting an export-oriented IT sector in Egypt.

The Egyptian equity market is one of the most developed in the region with more than 633 listed companies. Market capitalization on the exchange doubled in 2005 from USD 47.2 billion to USD 93.5 billion, with turnover surging from USD 1.16 billion in January 2005 to USD 6 billion in January 2006.

Property Market Review

After years of only state-built housing, in the early 1990s the government allowed private housing projects. And guess what happened? Inexperienced companies jumped in and soon you had a massive oversupply which soon ended up with many Developers going bankrupt (Will they never learn?! : )

But now, the situation has changed.........WHY? (do I hear everyone shout !!)

Well, if you wait a second, I'll tell you........:

- Egypt offers excellent rental income returns.

- The Gulf is now exploding with new oil money, and sees Egypt as less risky than Lebanon or Jordan.

- Egypt has a rapidly-growing economy (remember the 7%?) with a fast-growing outsourcing sector.

- There is enormous European interest in Red Sea property.

The government initiated a managed float of the Egyptian Pound in January 2003, leading to a sharp drop in its value which has since recovered. And what happens when a currency weakens against international currencies, and you have a significant Expat Community? They start buying of course !!! And so did everyone else............

The passing of the Real Estate Finance Law in May 2001, created a mortgage market. (Can you believe that it took them this long??!!!) For the first time since the 1948 civil code, banks can now repossess properties and evict owners who default on loan repayments.

Total mortgage lending is expected to grow rapidly to LE 4 billion (US$690 million) by the end of 2007, as the Egyptian Company for Mortgage Refinancing (ECMR) begins operations. ECMR is likely to help lower interest rates, which have hitherto been an obstacle to lower income groups. Lending rates in the 12% - 14% range have discouraged housing purchases, but in turn increased rentals due to affordability.

Now, let's start at how we as 'Foreigners' can secure property in the Land of the Pharaohs:

Foreigners can buy property in Egypt, under Law No 230 of 1996. (Well, that's a start J) But, foreigners cannot buy more than two pieces of real-estate, and the purchase must have the approval of the Council of Ministers, which takes around two months.

Property in Sharm El Sheikh follows a different regime where foreign purchasers in cannot acquire freehold rights, but only 99 year leases. Foreign purchasers must therefore follow a procedure called a 'signature validity court verdict'.

The 'signature validity court verdict' method could well become the dominant route for foreigners, because it allows the foreigner to buy as many properties as he likes, rent them, and sell when he likes.

The following steps must be taken:

1. A 'negative' certificate for the property should be obtained from the government, stating that there are no mortgages, pledges, or any other sort of rights on the property registered to any other party.

2. The tax authorities must issue a certificate stating what taxes are due on the property.

3. A sale / usufruct contract should be drawn up.

- The validity of the sale depends on the terms of the contract.

- So it is essential for the purchaser to have a detailed contract, defining the property boundaries, the purchase price, the method of the acquisition of the rights of the previous owner, and the method of payment.

- The contract must be in Arabic, since Arabic is the only language recognized by the courts. (very NB !!)

4. Purchasers must issue a power of attorney to their lawyer so that he can act on their behalf, a procedure which requires the purchaser to obtain a multi-entry visa:

- Then the lawyer files a legal suit to obtain a court verdict certifying that the signature on the sale / usufruct contract truly belongs to the seller

(This is the 'signature validity court verdict').

- This suit will take between 6-8 months.

It's always very important to have a look at the transaction costs involved when making your purchase, and to give yourself an idea of the 'hidden costs' involved, have a look at this table:

Transaction Costs

- Registration Fee EGP500 - EGP2,000 buyer

- Legal Fees 3% buyer

- Real Estate Agent's Fee 2.75% - 3.30%

- Transfer Tax 2.50%

- Capital Gains Tax 2.50%

- Costs paid by buyer 3.10% - 4.00%

- Costs paid by seller 7.75% - 8.30%

- Roundtrip Transaction Costs 10.85% - 12.30%

Source: Global Property Guide

Now that you have had a look at the Purchase Procedure, let's have a look at what the results could be once you do decide to buy. Here is the graph of Rental Yields & Property Prices per Type of Unit for Cairo:

CAIRO - MAADI - Apartments

Size: 250 sq.m.

COST (US$)

136,000

YIELD (p.a.)

17.32%

CAIRO - MOHANDESSEEN - Apartments

Size: 250 sq.m.

COST (US$)

149,750

YIELD (p.a.)

8.01%

CAIRO - ZAMALEK - Apartments

Size: 250 sq.m.

COST (US$)

294,750

YIELD (p.a.)

6.84%

Source: Global Property Guide

So the question is: Would you buy in Maadi at 17% Rental Yield?

YES I would !!! :)

Therefore, the transaction costs in itself are not too expensive, but it's the Buying Process that needs VERY careful consederation.................as it gets pretty complicated !!

Conclusion

Although all the economic and property market indicators, correctly point to Egypt as a awesome viable investment destination, there is 1 thing that bothers me:

Egypt relies heavily on tourism.

The tourism sector suffered tremendously following terrorist attacks on tourists in Luxor in October 1997,Sharm al-Sheikh in July 2005, and the town of Dahab in Red Sea resort in April 2006. And therefore, any type of terrosist attack can upset the entire region, and bode badly for the investor.

Other than that, at properties priced starting at £19k, who'll NOT be buying?

(Sources: http://www.globalpropertyguide.com/ , http://www.wikipedia.org/ & Daily Telegraph)

Saturday, 12 January 2008

Property Review - Turkey

Turkey – Where East meets West

Fast Facts

- Associate Member to European Union (Candidate to Full Membership)

- Registered Economic Growth of more than 8% in 2004 - 2005.

- Capital: Ankara

- Population: 71 million

- Currency: New Turkish Lira

Economic Overview

‘So, just to confirm, you would like the mezes as a starter, the kebab as the main course and the baklava for dessert? Would you like any strong, almost oil like, coffee with that? :)

As you await the arrival of your food, you can’t help but survey your surroundings, expecting a Turkey you envisioned in books and movies…………just to find that it’s not all a 3rd World marketplace teeming with camels, men in white linen and oceans of sand.

Welcome to the real Turkey.........

Turkey is a developed country, with a political system established in 1923, under the leadership of Mustafa Kemal Atatürk, following the fall of the Ottoman Empire in the aftermath of World War I. Since then, Turkey has become increasingly integrated with the West while continuing to foster relations with the Eastern world.

The Islamist-based Justice and Development Party, which won a landslide victory in November 2002, has been a powerful force behind resolving many of Turkey’s long-standing economic problems.Prime Minister Recep Tayyip Erdogan early identified EU entry (as he should :) as his government’s key priority. He has pushed reforms to the court system and increased freedom of speech, long restricted my military influence.

As you can see, there is a sharp increase after 2002 when the Justice and Development Party started their reforms to betterment of the Economy.

Though inflation has unexpectedly picked up to 10.5% in Q3 2006, due to the rise in oil prices and various supply shocks, the authorities will have no truck with renewed inflation, and a tightening of interest rates by 4% in June, and a further 0.25% tightening in July, is expected to squeeze the higher inflation out of the system.

Have a look at the nosedive that inflation has taken since the 1980’s!!

Turkey has recently experienced a strong economic performance – a 5.8% growth in 2003, 8.9% in 2004 and 7.4% growth last year. Because of the tightening of interest rates, GDP growth to the third quarter of 2006 was a restrained 5.9%, and the full year figure is likely to come in lower. But although the graphs above tell a story of a country on the up, the biggest hurdle that Turkey has to cross is becoming part of EU……….and this has been met with strong opposition from France and Austria :( Therefore, analysts expect EU accession negotiations to be difficult and slow.

Turkey has recently experienced a strong economic performance – a 5.8% growth in 2003, 8.9% in 2004 and 7.4% growth last year. Because of the tightening of interest rates, GDP growth to the third quarter of 2006 was a restrained 5.9%, and the full year figure is likely to come in lower. But although the graphs above tell a story of a country on the up, the biggest hurdle that Turkey has to cross is becoming part of EU……….and this has been met with strong opposition from France and Austria :( Therefore, analysts expect EU accession negotiations to be difficult and slow. Property Market Review

So, if EU accession is the only thing that prevents Turkey from becoming a viable investment option, why are investors so eager to become part of this Juggernaut while things are still relatively affordable? Well, I’ll tell you……….

House prices continued their increases on 2006, following very sharp increases in 2005. Exactly how much house prices have increased is hard to tell, as Turkey publishes no official house price statistics, nor do any private organizations of realtors publish statistics !!

Therefore, Turkey is relatively ill-served by international realtors…….(can you where the potential lies? :)

So, the international market seems to be climbing in abated………but what about the domestic market?

Domestic housing loans have risen from 2% of GDP two years ago, to 14.4% of GDP by end-December 2006.The engine behind the increased borrowing was a significant decline in interest rates until mid-2006 (when an upward blip in inflation caused a rate tightening).

If you don’t believe me about interest rates, have a look yourself……

So, now that we have found that buying in Turkey is viable, let’s look at the particulars……..namely the Buyer’s Guide and what it involves:

1) Foreigner Restriction to buying Property?

Foreign ownership in Turkey is ruled by the reciprocity principle.

Citizens of countries that allow Turkish citizens or legal entities to own property in their country are allowed to acquire property in Turkey. Citizens of most EU countries (except for Belgium, Cyprus, Czech Republic and Slovakia), the United States, Canada and other countries in Asia, Latin America and Africa can freely purchase properties in Turkey.

On 07 January 2006, a new law was enacted which put a limit to the amount of land that a foreigner can purchase. Foreigners are allowed to acquire a maximum of 30 hectares (74 acres) of real estate. Any piece of land exceeding 30 hectares requires a permit from the Turkish authorities.

2) Rental Yields steady?

Gross yields in Turkey are moderate to high. Properties in central Istanbul offer yields of 6% to 7.6%, while property in coastal areas can yield 13% to 16% (but rents in coastal areas are predominantly seasonal).

Property yields in the suburbs are generally more attractive than in the cities. While apartments in Istanbul yielded around 6% to 7.5% at end-2005, Ankara apartments yielded from 7% to 9.5%.

Houses in the suburbs of Istanbul yielded around 6.5% to 8.5%, while house in the suburbs of Ankara, could yield 12%.

3) Is Turkish Law Pro-Landlord or Pro-Tenant?

Rents may be freely agreed at the beginning of rental contracts between Tenants and Landlords.

The lessor is required to inform the lessee at least one month before expiration of the lease of the amount of rent he wants for the new rental period. If the lessee does not agree to this amount, the lessor may request an assessment of the rental value of the property by applying to a court. The court will take into account the report of an expert as to the amount of rent appropriate for the property in question, taking into account prevailing market rents.

Apart from there being no rent control, the Turkish legal system generally favours tenants.

4) How much tax will I pay on my Property?

An example of what a Non-Resident would pay:

Non-resident couple's joint monthly rental income:

Tax Example: €6,000

YTL6,600 – YTL15,000 ( 20%) 691

Now that Turkey is at the crossroads, between EU accession or not, the savvy investor should have a look at the calculated risk of investing in an economy where East meets West.

Monday, 17 September 2007

Property Review - South Africa

South Africa - The Rainbow Nation

Fast Facts:

- Africa 's Biggest Economy.

- The World's largest producer and exporter of Gold & Platinum.

- Capital = Pretoria

- Population = 47 million

- Currency = Rand

Economic Review

If you're a Private Investor sitting in New York / London, and you want to look at the 'possibility' of investing in Africa, where would you start? (I say possibility, because many people still see Africa as a basket case, and even the thought of investing there would warrant you a trip to the hospital and getting intimate with a straight jacket !!)

Normally, you would make a list of all the countries in Africa, and start from top to bottom.........but in the case of Africa, you would have start from bottom to top :)

South Africa (yes, the country and NOT the region) has since 1994 flourished under majority rule and is set to capitalise on this momentum for future generations.

Here's why:

- South Africa is ranked 24th in the World in terms of GDP , corrected for purchasing power parity.

- The Johannesburg Stock Exchange (JSE) ranks among the top 20 in the World.

- The South African Rand (ZAR) is the World's most actively-traded emerging market currency, and was the best-performing currency against the United States Dollar (USD) between 2002 and 2005.

- South Africa is also Africa's largest Energy Producer and Consumer.

So enough with the 'Colouring in the pretty Pictures and forgetting about the Reality' bit........let's get on with the hard facts, as Africa isn't called 'The Dark Continent' for nothing:

- South Africa has one of the highest rates of income inequality in the world.

- Unemployment sits at approximately 25%.

- The Crime Rate is one of the Highest in the World, but it is the increase of violent crime that is the biggest worry.

- With the crumbling of the Zimbabwean economy, refugees are streaming into South Africa with an estimated 2 million Zimbabweans already residing in South Africa.

So you may say, 'Please STOP' !!! With these statistics why would anyone in their right mind even have the notion of even looking at South Africa as an 'Investment Hotspot'???

I'll tell you why, and I promise to make it short........but Sweet :

1. The emergence of a black middle-class known as 'Black Diamonds'.

2. The 2010 Soccer World Cup.

3. The ratio of Disposable Income to Household Debt which is still only at 76%.

4. 93% of Land Claims have been completed.

5. Interest Rates are still at 25 year lows from a height of 25% in 1998.

Without trying to illustrate every point made above, I have focused on the correlation between interest rates and inflation below. And without further ado, let the pictures to the talking............ :)

Tito Mboweni (The South African Reserve Bank Governor) implements a monetary policy within an inflation targeting framework.......so what do these fancy words mean??? :

- In 'Layman's Terms - If inflation goes up, then interest rates go up.

- If inflation goes down, then interest rates go down.

So, to illustrate this, have a look at what the graphs tell us below:

So how do these graphs above explain the growth experienced in the Property Market?

- - If inflation goes up, interest rates go up and house price growth slows.

- - If inflation goes down, interest rates go down and house price growth increases.

Property Market Review

So, as mentioned in the Economic Review, there are 5 major factors that make South Africa a great place for property investment..........but what exactly are these 5 factors and how will they affect the Property Market??

Let's discuss these them one by one:

1. 'Black Diamonds' - An emerging black middle-class

- Of the 28,8m adult South African population, 21,9m are of black origin:

- Of those, 2m fall into the category called "Black Diamonds" - Black Diamonds are a group characterised by a certain amount of wealth, education and other middle-class determining factors.

- Black diamonds make up 10 percent of black South Africans, but are responsible for 43 % of black consumer buying power, amounting to a value of approximately R130-billion.

- Their growth has been recorded at 30% over the space of the last year.

2. 2010 Soccer World Cup (SWC) - The Biggest Event in the World

- Estimated 450 000 soccer fans are expected to visit South Africa for the SWC .

- These fans will spend in excess of R30 billion while enjoying the tournament.

- This 'cash injection' will push the economic growth rate up to 6%.

- 150 000 jobs will be created during the tournament.

- R5 billion for spending on stadiums (Renovate existing and New-built)

- R24 billion spending on Gautrain linking Pretoria , Johannesburg and OR Tambo International Airport.

3. 'The Ratio' - Disposable Income to Household Debt

Disposable income is the amount that you're left with after all taxes have been paid.

Household Debt is things such as mortgage / vehicle finance payments, credit cards and Loans.

- South Africa 's disposable income to household debt is 76%.

- So for every R1 that you make after taxes have been paid, you have to pay 76c toward payments and you are therefore left with 24c.

Now you think, WOW, 'For every R1 I earn I have to fork out 76c before I can start saving'??? (that's if you're the saving type :) That's rediculously high !! So, let's compare it to some other countries:

- Germany = 115%

- Japan = 140%

- UK = 142%

- Australia = 171% !!

As you can see, South Africa 's ratio pales in comparison to other countries around the World !!

4. 'The Zimbabwe Scenario' - To take or not to grab the Land

- 97% of South African land claims have been settled, thereby leaving the issue of 'Zimbabwe Land Grabs', becoming a reality in South Africa, as very unlikely.

5. 'The Interest Rate' - Currently at a 25 year low

- From a record interest rate of 25% in 1998, South Africa is experiencing 25 year low interest rates.

- The current Repo Rate (the rate at which the SA Reserve Bank loans money to Commercial banks) is currently at 10% while the Prime Rate (the rate at which Commercial Banks loan to the public) is at 13.5%

- With inflation being kept in the monetary policy range of 3-6%, any significant increases seem unlikely.

Just to give yourself a little bit of time to digest all the 'heavy' information above, let's look at some pictures !!

Look at the House Prices to Income graph below:

As you can see, compared to the UK , Australia and USA, South Africa's house prices are still very much under-valued.

- And coming from such a low base regarding property growth, is this where the party ends !! To quote the song from BTO.........'You aint seen nothing yet' :)

Conclusion

As South Africa moves into almost 15 years after the end of 'Apartheid', there are signs that the 'Lighthouse of Africa' still had a far way to go in order to be competitive on the world stage.

But with onset of a new era, with the new black-middle class, 2010 Soccer World Cup, comparatively low Disposable Income-Household Debt ratio, the 'Zimbabwe non-issue' and low interest rates at 25 year lows.........things are definitely on the up for the 'Rainbow Nation'.

Wednesday, 15 August 2007

Property Review - Germany

Germany - The Land of Poets and Thinkers

Fast Facts:

- The World's 3rd Largest Economy.

- The World's biggest Exporter & 2nd biggest Importer of goods.

- Capital = Berlin

- Population = 82 million

- Currency = Euro

Economic Overview:

Just for a second, believe that you are a Poet or a Thinker, and think 'Germany'........and see what comes to mind: Beer, very loud Techno Music and hair gel........?? Maybe :)

But the truth stands that 'Deutchland' (as it is affectionately known) is on the up........and on the up in a big way !!

This is why:

- Germany has the largest economy in Europe and the third largest economy in the world, behind the United States and Japan.

- It is ranked fifth in the world in terms of Purchasing Power Parity ( PPP ) (Note: PPP is based on the law of one price, which is the idea that, in an efficient market, identical goods must have only one price)

- According to the World Trade Organization, Germany is the world's top exporter with $1.133 trillion exported, from the beginning of 2006. Most of the country's exports are in engineering, especially in automobiles (Mercedes, BMW, Audi - as is expected), metals, and chemical goods.

- In the service sector, Germany ranks second behind the United States and in terms of total capacity to generate electricity from wind power, Germany is first in the world and it is also the main exporter of wind turbines.

Now you may think, 'That's all very well, but these are facts which are contrived and any country in the World will have 'at least something that they can be proud of and be able to quote them in neat little paragraphs as above'............(well, at least most countries :)

But this little lesson on Deutchland has not yet run its course, Dear Reader......please, read on:

- Although problems created by reunification in 1990 have begun to decline, the standard of living remains higher in the western half of the country than in the eastern half.

- Germans continue to be concerned about a relatively high level of unemployment, especially in the former East German states where unemployment tops 18% !! :(

Now here comes the important reasons 'Why Germany has not performed':

In spite of its extremely good performance in international trade, domestic demand has stalled for many years because of stagnating wages and consumer insecurity.

Germany's government runs a restrictive fiscal policy and has cut numerous regular jobs in the public sector. But while regular employment in the public sector shrank, "irregular" government employment such as "one euro" jobs (Jobs which are temporary & very low wage paying), government supported self-employment, and job training increased.

But there is a silver lining (At last they cry !!) :

- The national economy has nonetheless shown signs of improvement in recent years, as the economics magazine Handelsblatt declaring Germany one of the most competitive in the Eurozone. Economists for the Institute for Economic Research in Berlin expect Germany's economic growth to increase consistently over the next few years.

Property Overview:

Now that the boring 'Economic Bla-Bla' is out of the way, let's get back to the interesting part and the reason why we're writing this Blog........Property !!!

When comparing a potential investment country, we should always look at the historic information that we have available, as we don't know what will happen in the future.........(for those who know what will happen in the future in international property, please drop me an e-mail so we can share :)

So here is the 'Historic Information Bit' :

- In the past, a lot of investment in Berlin and the so-called Neue Bundesländer (New Federal Countries) had turned bad. Rents calculated as the basis of the investments were not attained, and whole buildings stood empty for long periods, despite their high quality.

At the same time the real estate market in much the former West Germany remained stagnant for much of the nineties. - However, in 2003 owner-occupied apartment prices in South-Western Germany, especially in smaller cities, began to recover.

- But the housing market has turned around only in the most economically successful cities. (NB)

- Munich prices have been rising, and the city now has perhaps the highest per square metre apartment prices in Germany , with Frankfurt and Berlin trailing behind.

Enough of all this writing, let's see some pictures !! (but they do have a purpose other than just looking pretty) :

As you can see when looking at the graphs above, the market increased sharply after 1990 until 1995 (which was when supply was more than demand) when properties built was at a high.

As you can see when looking at the graphs above, the market increased sharply after 1990 until 1995 (which was when supply was more than demand) when properties built was at a high.

Now that properties built have decreased considerably since 1995, demand will increase again due to demand being more than supply. So the very simple 'Law of Demand and Supply' can be explained here:

- Too many houses, less houses demanded and Prices decrease.

- Too few houses, more houses demanded and Prices increase.

Over the last decade rents have been stagnant or have fallen. Rents today are still 13% lower in nominal terms than at their 1994 peak, and have declined very significantly in real terms.

- However, the fall in rental levels has been less than the decline in property prices, leading to higher yields.

And now a little bit of information on those VERY important yields :

- Rental yields in small flats in Berlin (30 - 75 sq. m.) are generally higher than other sized units, at 7% - 7.35%.

- Bigger properties have yields at 5% to 5.5%. Rental yields for Frankfurt flats range from 5% to 6.6% while Munich flats have lower yields, at 4.4% to 4.6%.

One of the most important things about why Germany is a very viable property investment destination, is that more Germans live in rented accommodation than in their own homes. About 58% of households are renters, which is one of the highest proportions in the world !!!

Development Overview - Peter Vischer Strasse, Berlin

Although Horizon Consultancy have more than one investment opportunity in Germany , I think that the Peter Vischer Strasse in Berlin is the best option.

Here is why:

- The Peter Vischer Strasse is situated in the Schaneberg area which is one of the most popular and desirable residential areas of Berlin.

- This premier six-storey residence overlooks a beautifully maintained communal garden area, and is situated just a few minutes' drive from the world-famous Kurfarstendamm shopping avenue.

- It was originally constructed during the rebuilding of Berlin during the Fifties & has recently had major renovation work done which has now been completed. (We wouldn't want you living / buying a bomb shelter now, would we?? :)

- Strolling around the private garden area that is encapsulated by these apartments you get a real feel of quality construction combined with modern standards, and all the time in keeping with its history and charm.

The Important Facts on the Development :

- As an average, only 15% of the population of in Berlin own the respective house that they are living in.

- Over 40% of the apartments in Peter Vischer Strasse are owned by the tenants themselves, therefore solidifying the attractiveness of these apartments.

- Along with the option of a 10-year rental guarantee and an interior renovation of the apartment, this proposal really is as close as you can get to a perfect investment vehicle.

Capital Gains tax is not applicable if the apartment is owned for 10 years or more, and sold thereafter. - Surrounded by a wide variety of shops, restaurants and bars and within walking distance of the underground, this property offers investors a tremendous opportunity to claim a stake in Europe 's youngest capital.

The trendy Schaneberg district - birthplace of Marlene Dietrich - is renowned for its bohemian atmosphere and style, and the network of cool coffee shops, curious boutiques and trendy "places to be seen", is ever-more beguiling.

Conclusion:

Germany , although not without its inherent problems such as high unemployment, is in a unique position to record excellent growth over the next few years.

Growth in Berlin alone has been predicted between 10-15% for the next 10 years & will have a good chance of meeting these expectations due to the recent Soccer World Cup investments and exposure experienced.

Mortgage deregulation is on the horizon (as happened in UK in late 1970s where suddenly people could buy without having to produce 25-40% deposits).

(Sources: http://www.globalpropertyguide.com/ , http://www.wikipedia.org/ Reuters & Daily Telegraph)